Workforce Management Agency helps businesses find payroll service solutions!

The Burden of Figuring Out Costs When it Comes to a PEO Service Provider Falls the Client.

Workforce Management Agency will help find “TRUTH IN PEO”:

Often PEO’s will bundle those expensive administrative fees. We can help to uncover the actual costs associated to PEO billing. In our proposal system we also attempt to familiarize clients and brokers with the process of determining true costs.

Clients of PEO’s often do not understand how they are charged. Even more ridiculous, they often think they are paying much less then they actually are.

TRUTH IN PEO SERVICES: Workforce Management Agency helps you define your actual spend!

We break down complicated invoice reporting practices known in the PEO industry as bundled billing rates:

When a PEO company combines the employer taxes: FICA, FUTA, SUTA, along with their Administrative Fees and Worker’s Compensation as a percentage of payroll charged against gross wages it’s a very difficult process to break out as a line item allocation. Taking into account the wage base cutoffs of the employee payroll tax portion of gross wages paid out often PEO’s have major profitability when they use the practice of bundling their rate.

PEO’s over the years have become more ethical in their quoting approach by offering an itemized breakout report showing line items of true labor costs and where employer funded payroll costs are allocated to. Usually shown in different reports depending upon which PEO provider is servicing the client. Clients of specific vendors often save boatloads of money shopping the market because PEO’s similar to ADP Total-source are infamous for this practice. WMA will find out the true cost of administering payroll, worker’s compensation, benefits, and HR for you!

Percentage based fees Vs. Flat rate billing (PEPM)Per Employee Per Month, and Per check Fees are usually calculated in quotes from the PEO relative to what a percentage would have been and sometimes it makes sense, other times and most often it doesn’t, not at all depending upon the specific financials per client-company.

The importance of an ESAC Accredited and Audited PEO. As of January 2017 the first set of PEO’s have been certified as CPEO’s. The IRS has enabled PEO’s to become a successor employer which benefits the PEO and its client by alleviating the tax restart implications of switching PEO’s mid-year. The certification process also protects businesses that are clients of PEO’s from certain instances of fraudulent activity relating to tax remittance.

What to understand your true costs and why these accreditations are so important? Have more questions?

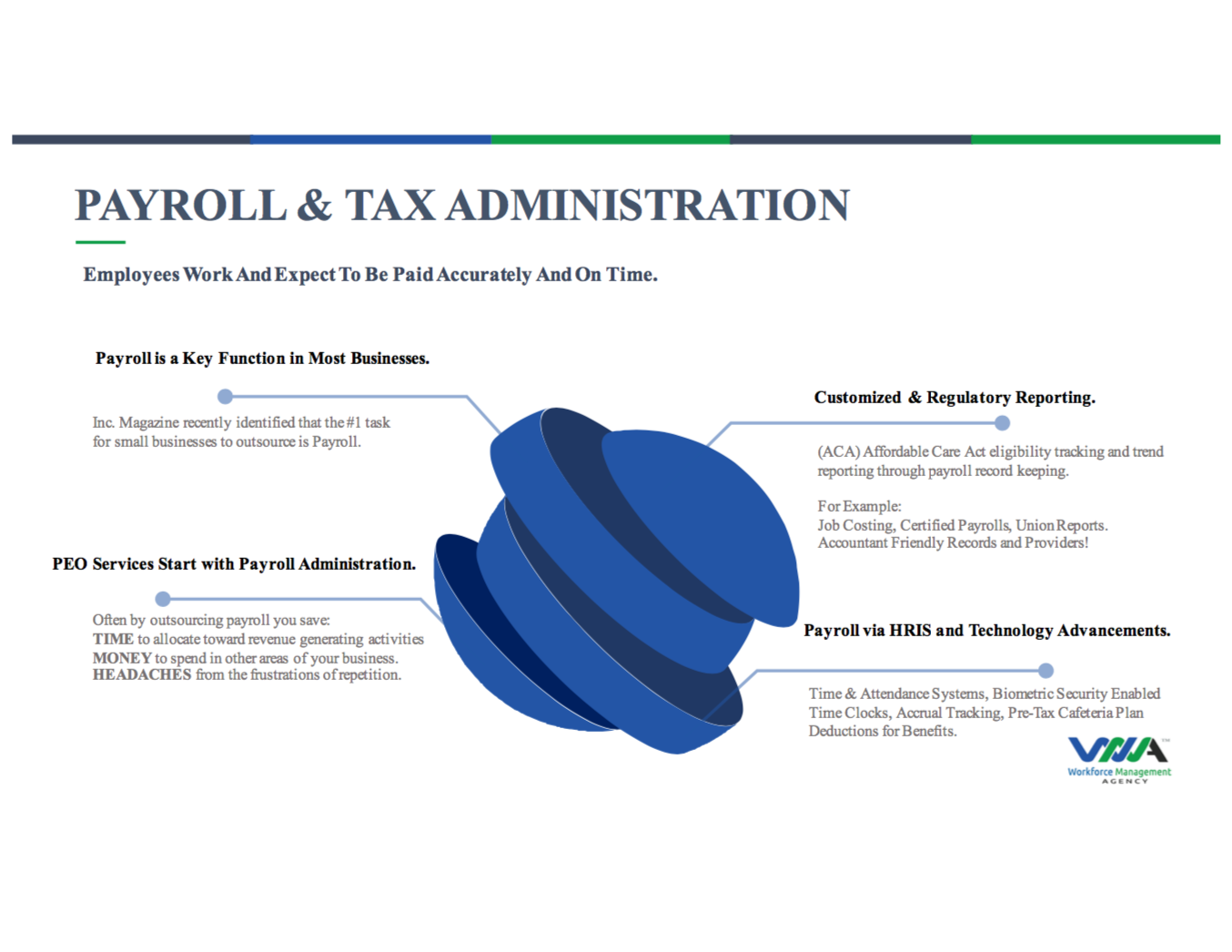

Finding the right PEO payroll for your operating needs is essential.

- Technologically Advanced:

- Payroll Services

- Time & Attendance Systems to keep track of employee hours for payroll cycles.

- Biometric Fingerprint Secure Time Clocks are available for added security.

- Accrual Tracking for employee earned Paid Time Off (PTO)

- Job Costing for both labor and material costs.

- Custom Report Writing Systems can help to customize any type of report your payroll department may want.

- Year-end W2 Preparation and Administration

- Employees go to work and expect to be paid accurately and on time.

- (ACA) Affordable Care Act eligibility tracking through payroll record keeping.

PEO’s give their customers access to (HRIS)Human Resources Information Systems where both the employer and its employees can log-in to administer much of the daily needs within the employer-employee relationship. Employees often gain access to self service platforms where they can find answers on their own to personal finance and benefits questions instead of asking management, whose time is then more effectively spent on revenue producing activities.